Smart Coverage for a Changing Climate

Who We Are

AboutUs

Weather.BI™ provides business owners lost revenue compensation when specified weather events, such as wildfires or rainfall events, significantly reduce sales — even when there is no physical property or equipment damage.

Who We Are & What We Do

We offer weather-triggered income protection designed specifically for small to mid-sized businesses that assist in staying financially resilient when weather disrupts operations.

What Problem We Solve

Traditional insurance doesn’t cover lost revenue from weather disruptions. Weather.BI™ cushions your bottom line against income loss from weather-related slowdowns, even when there’s no physical damage.

What Weather Events Are Covered

Extreme temperature, high and low, and rainfall. These are accumulated averages over 7-day periods.

We pay when weather conditions hit your risk parameter – no claims process, no adjusters. Our policies use real-time weather data and predefined parameters to automatically trigger fast, hassle-free payouts.

The Right Choice For You

Business Interruption IsPainful

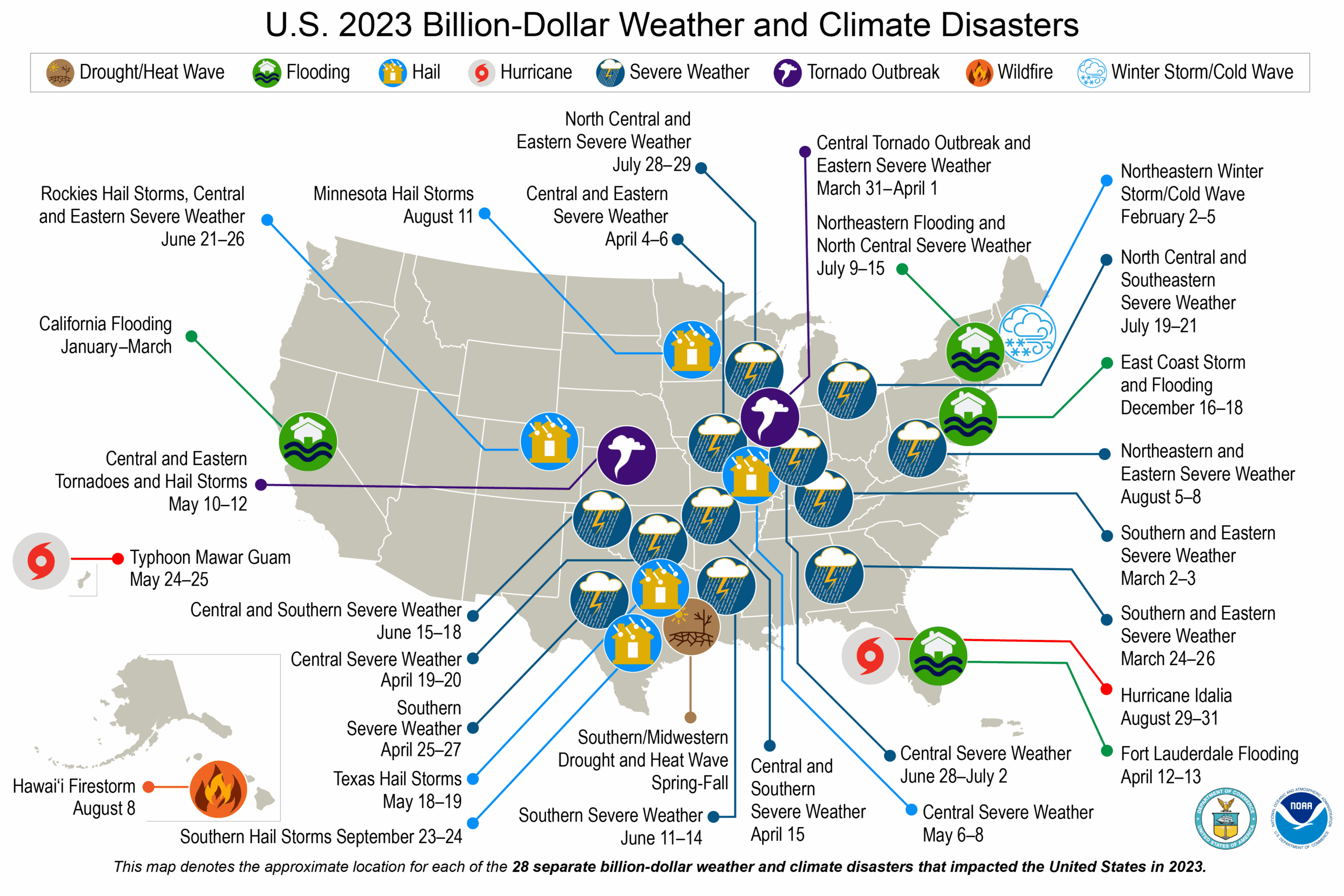

In 2023, extreme weather caused $114 billion* in US economic loss—but much of that damage isn’t insured.

Extreme temperature and excess rainfall can hurt your client’s business by disrupting their customers’ behaviors and the lives of their employees, causing lost sales and additional expenses for them to maintain their operations.

*AON 2023 WEATHER, CLIMATE AND CATASTROPHE INSIGHT REPORT

A Better Understanding

How ItWorks

01

Policy Set Parameters

Define the specific weather conditions that must be met to trigger an automatic payout.

02

Weather Events

Specific weather events—such as floods caused by rainfall, or extreme temperatures—meet the policy’s trigger conditions.

03

Get Paid

Get paid automatically when the weather data matches your policy’s trigger—no claims process required.